Exactly How Medicare Supplement Can Boost Your Insurance Coverage Insurance Coverage Today

As people browse the details of medical care plans and seek extensive protection, comprehending the nuances of additional insurance coverage ends up being significantly important. With a focus on linking the voids left by typical Medicare strategies, these supplementary options provide a tailored method to meeting specific demands.

The Essentials of Medicare Supplements

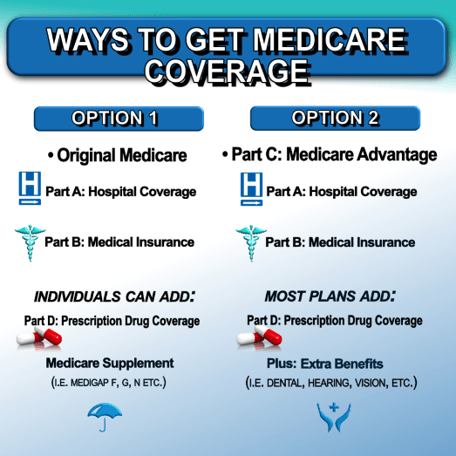

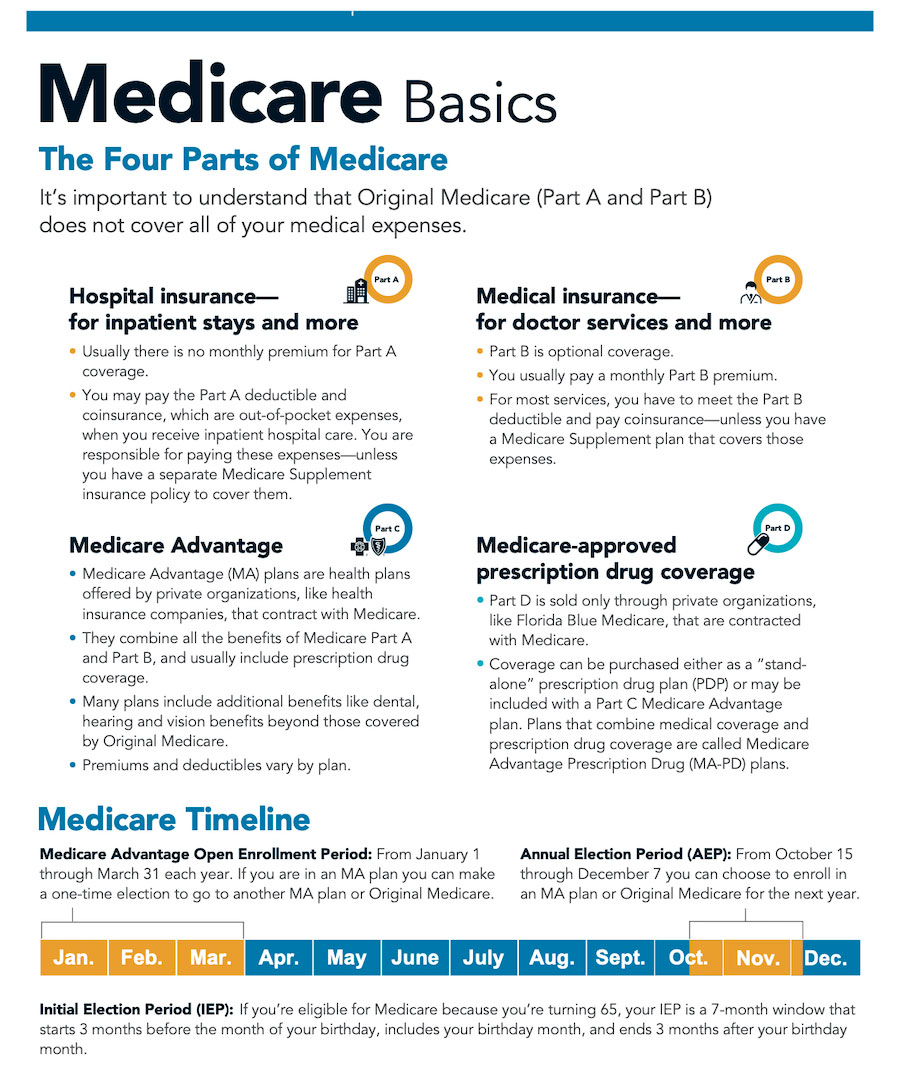

Medicare supplements, also referred to as Medigap strategies, offer extra insurance coverage to fill the spaces left by original Medicare. These supplementary plans are used by exclusive insurance business and are created to cover expenditures such as copayments, coinsurance, and deductibles that are not totally covered by Medicare Part A and Part B. It's important to keep in mind that Medigap strategies can not be made use of as standalone plans yet job alongside original Medicare.

One key element of Medicare supplements is that they are standardized across a lot of states, supplying the very same standard advantages regardless of the insurance company. There are 10 various Medigap plans identified A with N, each supplying a various degree of protection. Plan F is one of the most thorough options, covering practically all out-of-pocket costs, while other plans might use a lot more restricted protection at a lower costs.

Recognizing the essentials of Medicare supplements is critical for people approaching Medicare eligibility that desire to improve their insurance protection and lower possible monetary concerns connected with medical care costs.

Comprehending Insurance Coverage Options

When taking into consideration Medicare Supplement intends, it is critical to recognize the various protection choices to guarantee extensive insurance coverage security. Medicare Supplement plans, additionally recognized as Medigap plans, are standardized across the majority of states and classified with letters from A to N, each offering differing levels of coverage - Medicare Supplement plans near me. Additionally, some strategies may offer insurance coverage for services not consisted of in Original Medicare, such as emergency care during international travel.

Benefits of Supplemental Plans

Additionally, supplemental plans provide a wider variety of insurance coverage alternatives, consisting of accessibility to more helpful hints healthcare service see this website providers that may not accept Medicare project. One more benefit of additional plans is the ability to travel with tranquility of mind, as some strategies supply insurance coverage for emergency situation clinical solutions while abroad. On the whole, the advantages of supplementary strategies add to a much more extensive and tailored approach to healthcare coverage, making certain that people can get the care they need without facing frustrating monetary problems.

Expense Considerations and Savings

Offered the monetary safety and broader coverage choices offered by supplemental plans, an important element to consider is the price considerations and possible cost savings they provide. While Medicare Supplement plans call for a regular monthly premium along with the conventional Medicare Part B premium, the advantages of minimized out-of-pocket great site costs often exceed the added expenditure. When assessing the price of extra plans, it is vital to contrast premiums, deductibles, copayments, and coinsurance throughout different plan kinds to identify one of the most economical option based upon individual health care needs.

Additionally, choosing a plan that straightens with one's health and wellness and budgetary needs can lead to substantial savings gradually. By selecting a Medicare Supplement plan that covers a higher percent of health care expenditures, individuals can reduce unanticipated costs and budget plan extra efficiently for medical treatment. Additionally, some extra strategies offer home price cuts or motivations for healthy actions, providing additional chances for price financial savings. Medicare Supplement plans near me. Ultimately, investing in a Medicare Supplement strategy can supply beneficial financial security and assurance for recipients looking for thorough coverage.

Making the Right Selection

Choosing the most appropriate Medicare Supplement plan necessitates careful consideration of individual medical care demands and economic scenarios. With a selection of plans offered, it is crucial to examine aspects such as protection choices, premiums, out-of-pocket prices, service provider networks, and overall worth. Recognizing your existing wellness condition and any type of anticipated clinical requirements can direct you in choosing a strategy that uses detailed coverage for solutions you might call for. Furthermore, examining your budget restraints and contrasting premium costs amongst different plans can aid guarantee that you select a strategy that is affordable in the long-term.

Conclusion